Why OTP SMS services are essential for Bangalore based fintech startups?

Widely recognized as the Silicon Valley of India, Bangalore has become a hub for fintech startups. These startups are driving innovation in digital payments, lending, investment platforms and more. But with this growth comes the dual challenge of ensuring robust security and a seamless user experience. OTP SMS (One-Time Passwords) services have become the cornerstone of this ecosystem and enable fintech startups to effectively address these challenges.

Here's a deep dive into why OTP SMS services are indispensable for fintech startups in Bangalore:

1. Securing real-time transactions

In the rapidly changing fintech landscape, the ability to secure transactions in real time is essential. OTP SMS ensures that every transaction, be it a fund transfer or a payment, is instantly verified. This reduces the risk of unauthorized access and fraud and builds user confidence.

Example: A Bangalore-based payment gateway startup uses OTP authentication to confirm high-value transactions, ensuring user security and peace of mind.

2. Compliance with RBI and regulatory norms

The Reserve Bank of India (RBI) mandates strict security protocols for digital financial transactions. OTP SMS services are essential to comply with these regulations as they provide a secure authentication layer to authenticate users and approve transactions.

Unique insight: Fintech startups in Bangalore often face audits to demonstrate compliance. OTP protocols serve as documented proof of secure and authenticated interactions and streamline these processes.

3. Cyber Crime Prevention in Digital Economy Bangalore

As digital adoption increases in Bangalore, so do the risks of cyber crimes like phishing and account compromise. OTP SMS services act as the first line of defense to prevent unauthorized access even when credentials are compromised.

Statistical overview: According to reports, India has witnessed a 50% increase in phishing attacks targeting fintech apps. OTP SMS can effectively mitigate these risks.

4. Improving user experience

For startups, acquiring and retaining users is paramount. OTP SMS simplifies onboarding by enabling instant account verification. Users can sign up and start using fintech apps within minutes, improving the overall experience.

Unique Perspective: Many fintech apps in Bangalore integrate multilingual OTP SMS features to cater to the city's diverse demographic and further enhance user satisfaction.

5. Building trust in emerging fintech segments

Startups in niche fintech areas such as blockchain, micro-lending and cryptocurrency trading face skepticism from new users. OTP SMS adds a layer of transparency and trust, ensuring users have secure interactions.

Example: A Bangalore-based cryptocurrency startup uses OTP to authenticate every login attempt, addressing users' concerns about the security of digital assets.

6. Facilitating seamless API integration

Bangalore-based startups often run on modern technology systems and require seamless service integration. OTP SMS APIs offered by leading providers enable secure authentication processes to be easily built into fintech applications, reducing deployment time.

7. Low cost scalability for fast growing startups

Bangalore is home to fast-growing startups that need secure yet cost-effective solutions to handle a growing user base. OTP SMS services are highly scalable and allow startups to process large transaction volumes without significantly increasing costs.

Unique Feature: Unlike other solutions, OTP SMS does not rely on smartphone penetration or internet availability, making it universally available.

8. Support innovative use cases

Fintech startups are experimenting with unique OTP SMS applications beyond traditional usage. Examples:

Dynamic OTPs: One-time OTPs associated with specific actions, such as changing payment limits.

Time-limited OTPs: Increase security for high-stakes transactions by limiting OTP validity to seconds.

9. Strengthening partnership with banks

Fintech startups in Bangalore often partner with banks to offer services like UPI integration or digital loans. OTP SMS ensures seamless and secure communication between banks, fintech platforms and end users and strengthens these partnerships.

10. Creating a competitive advantage

In a crowded fintech ecosystem like Bangalore, offering secure and user-friendly services can set a startup apart from the rest. Simple and reliable OTP SMS services give startups a competitive edge and help them attract and retain customers.

OTP SMS - Growth Catalyst for Fintech Startups in Bangalore

In a city as dynamic and innovative as Bangalore, fintech startups must prioritize user security and trust to thrive. OTP SMS services address these critical needs by offering real-time authentication, compliance and fraud prevention. In addition to security, they also improve user experience, scalability and operational efficiency.

For Bangalore-based fintech startups trying to succeed in a competitive market, investing in a reliable SMS OTP provider isn't just an operational necessity – it's a strategic advantage.

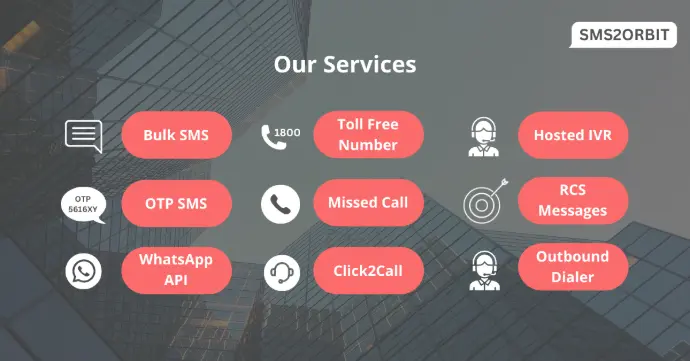

If you're looking for an OTP SMS service tailored to your fintech needs, explore SMS2Orbit, a trusted provider of scalable, cost-effective and secure solutions for high-growth startups.

If More Information About The SMS Service Provided By SMS2ORBIT Is Desired, Please Don’t Hesitate To Contact The Business Team. They Can Be Reached At business@sms2orbit.com Or By Calling 97248 55877.